For those of you who haven’t yet filed your taxes, you have only two weeks left. This article will show you the basics of filing your taxes. Due to the always changing tax regulations, be sure to consult with your

tax professional in order to address your particular situation.

The tax man cometh! Tax time can be stressful for some people and a joyous occasion for others. For some people, it means big refunds…for others, big headaches! This report was written to help out with some basic information that almost everyone needs to know about filing taxes. You will find information about how to file, as well as, where to file for the most stress-free tax prep experience.

Let’s get started!

Where Do I Begin?

[emember_protected]

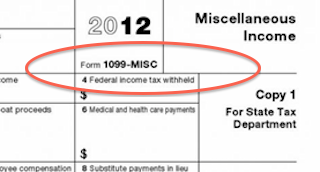

Begin at the beginning! (Sorry, couldn’t resist!) A proactive way of approaching preparing your taxes is to wait for all of the necessary forms. These forms include, but are not limited t0

- W-2’s

- 1099s

- Student Loan Interest Forms

- Statements From Church

- Daycare Expense Statements

All of these forms could help you get the maximum refund you may be due. If you are itemizing, make sure you have all of your receipts together. It’s always a good idea to save your receipts in a central location or file or scan them and save them on your computer. If you save them on your computer, make sure you back up your system just in case your computer crashes. Also, if you have children, make sure you know or have their social security numbers handy. Another important document to have before you begin is your prior year tax return. If this is your first year filing, then obviously you don’t have to worry about this document.

How Do I File My Taxes?

There are more answers to this question then you may be aware of. You can file your taxes by going to one of the many tax preparers that are on almost every street corner. You know the ones. Yup, the commercial tax preparers that have someone dressed up as the Statue Of Liberty dancing and waving at you as you pass by in your car. If you choose this route, make sure you have all of your important documentation with you. To have your taxes done here, you either have to pay a fee up front or have the fee taken out of your tax refund before the money even gets placed in your hand.

Another paid option is to use online tax software, like TurboTax. The fee to use this online software is much less than going into somewhere like Jackson Hewitt, but you will have to prepare your taxes yourself. It’s really not as scary as it sounds. Software like TurboTax walks you through all of the questions you need to answer in order to get your taxes correct.

Most online tax softwares like TurboTax also have online customer support if you have any questions while filing. So you are not really alone. Did you know that you could possibly qualify to use TurboTax and other online softwares for free? Yes you could!

Most online tax softwares like TurboTax also have online customer support if you have any questions while filing. So you are not really alone. Did you know that you could possibly qualify to use TurboTax and other online softwares for free? Yes you could!

Go to http://www.irs.gov/. Look over to the right under “Filing & Payment”. Click on “FreeFile”. Then follow the 3 step process to determine which free option you would like to use. Everyone is eligible to use the Free File Fillable Forms, but no state tax returns are included. If your AGI falls within a certain range or under a certain amount, you may qualify to file your state and federal tax return for free online.

Follow the above steps to see if you are eligible. Your last option is to go to your local IRS office. Here you will be able to sit down with people that actually work for the IRS and have them help you with your taxes. This is a free service; you just have to be willing to wait because it’s on a first come, first served basis.

What Next?

After gathering all your important documents and choosing an option for filing, now all you have to do is file! All previous tax years must be filed by April 15th of the current year. A little confusing??

Let me give you an example: Your 2009 tax return must be filed no later than April 15, 2010. There are some exceptions to this rule. You may extend your due date by filing an extension request. This can be done by going to http://www.irs.gov/ and search for “extension” in the top right hand corner Search bar. Another time April 15th won’t be the due date is when the 15th of April falls on a weekend like it does in 2012.

Conclusion

This report is a very short run-down of some of the most basic topics involving filing a tax return.

Everyone’s situation is different and will require different ways of preparing. It is highly recommended that you speak with a professional, whether it be an attorney or tax professional, to make sure that you get all of the deductions available to you and to ensure you don’t leave anything out. We are not lawyers or tax professionals and cannot give you specific tax advice. If you still have questions that have been left unanswered, please call the IRS at 1-800-829-1040 Monday-Friday 7am-7pm your local time or visit http://www.irs.gov/.

Disclaimer: This report is not meant to give you tax advice. This report is solely for informational purposes only. Please consult a tax attorney for your specific situation before following any information within this report.

[/emember_protected]

RESOURCES: